AEPS - Bridging the Gap in Financial Inclusion

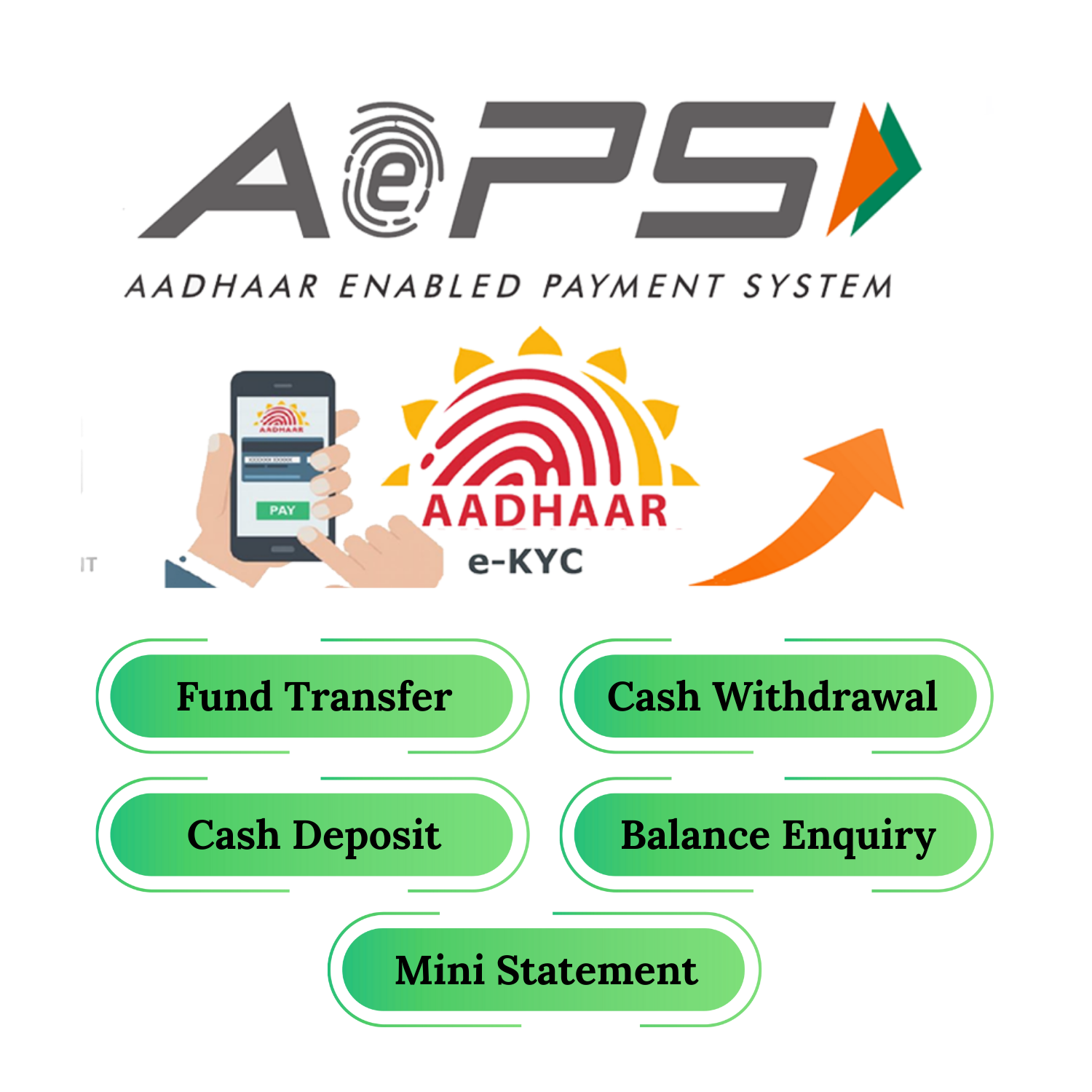

AEPS works on the unique Aadhaar number, which is linked to a user’s bank account. When a customer wishes to make a transaction—such as withdrawing cash, checking their balance, transferring funds, or obtaining mini-statements—their biometric details (fingerprint or iris scan) are used to authenticate the transaction.

This means that there’s no need for traditional bank infrastructure like debit cards, PINs, or even smartphones. With a simple biometric scan, customers can access their bank accounts, making it an ideal solution for those who lack access to physical banking facilities or have low-tech resources.

Empowering Agents and Retailers with AEPS

For businesses and agents, AEPS opens up a world of opportunities. Sikhwal Multiservices Pvt. Ltd. equips agents with the tools and technology to provide these banking services at the grassroots level. By setting up an AEPS terminal at a retail shop or local service center, agents can offer essential banking services, such as cash withdrawals, balance inquiries, fund transfers, and mini-statements.

This helps local retailers diversify their offerings and generate additional revenue streams. It also provides an opportunity to build customer loyalty by offering reliable, easy-to-access financial services that customers need.

Advantages of AEPS for Customers.

- No Need for Debit Cards or PINs: One of the biggest advantages of AEPS is that customers don’t need a debit card or PIN to access their accounts. All they need is their Aadhaar number and biometric details. This makes the system both secure and easy to use, especially for people who may not be familiar with traditional banking methods.

- Biometric Authentication for Security: AEPS uses cutting-edge biometric authentication—fingerprint or iris scan—to verify the identity of the user. This ensures that transactions are secure, reducing the chances of fraud or unauthorized access to bank accounts.

- Access to Banking Services in Remote Areas: AEPS facilitates banking transactions in remote or underserved areas where traditional ATMs or banking branches may not be easily accessible. It bridges the gap between rural customers and the banking system, making banking services available to everyone, regardless of their location.

- Instant Transactions and Real-Time Processing: With AEPS, transactions are processed in real-time, providing immediate confirmation to the customer. Whether it’s withdrawing cash or transferring funds, AEPS ensures that customers receive instant feedback, giving them confidence in the system.

- Cost-Effective Transactions: AEPS offers a low-cost solution for users, making it an affordable option for both customers and businesses. With minimal infrastructure requirements, businesses can offer banking services without the heavy costs associated with setting up traditional banking infrastructure like ATMs.

Benefits of AEPS for Merchants and Retailers

- Enhanced Customer Footfall Retailers and small businesses can benefit from AEPS by attracting more customers to their stores. With the ability to offer banking services, businesses can become one-stop shops for customers who want to perform essential banking transactions while they shop.

- Increased Revenue Streams: By integrating AEPS into their business model, retailers can earn commissions on each transaction performed. Whether it’s cash withdrawal, mini statement, or fund transfer, businesses can monetize these services and boost their overall revenue.

- Expansion of Customer Base: Offering AEPS services can also help businesses expand their customer base. People are more likely to return to a retailer that provides convenient banking services, which helps create long-term customer relationships.

- Simple Setup and Low Overhead Costs: The AEPS system requires minimal setup—just a biometric scanner, internet connection, and software platform. This makes it an affordable solution for businesses of all sizes. There’s no need for costly infrastructure like ATMs or point-of-sale (POS) systems, making AEPS a highly cost-effective service for retailers.

- Building Trust with Customers: By offering AEPS, businesses demonstrate their commitment to customer satisfaction and service quality. The convenience of providing essential financial services can help build trust with customers, making them more likely to return for future transactions.

Compliance and Security in AEPS

Sikhwal Multiservices Pvt. Ltd. ensures that all AEPS transactions are fully compliant with *NPCI (National Payments Corporation of India)* and *UIDAI (Unique Identification Authority of India)* guidelines. This guarantees that all transactions are secure and comply with national standards for data protection.

We also offer continuous support and training to our agents, ensuring that they understand the AEPS system thoroughly and can guide customers through the process efficiently.

The Role of AEPS in Financial Inclusion

AEPS is not just a payment solution; it’s a tool for driving *financial inclusion*. It helps bring millions of unbanked individuals into the formal banking system, making it easier for them to access essential financial services. In India, where a large portion of the population lives in rural areas, AEPS is a crucial step towards digital empowerment.

By leveraging AEPS, businesses can play an active role in enhancing financial inclusion, improving access to banking, and supporting national financial literacy efforts.

How to Get Started with AEPS

Getting started with AEPS is simple with Sikhwal Multiservices Pvt. Ltd. We offer all the necessary infrastructure, training, and support to set up AEPS terminals. Our comprehensive onboarding process ensures that agents can start providing AEPS services quickly and efficiently. Here’s how it works:

- Sign Up with Sikhwal Multiservices Pvt. Ltd.: Once you sign up, we provide the necessary AEPS equipment and guide you through the setup process.

- Train Your Staff: Our team provides training sessions to ensure that you and your staff understand how AEPS works and can assist customers with their transactions.

- Start Offering Services: After setting up the system, you can start offering AEPS services immediately, attracting more customers to your business.

- Earn Commissions: For every AEPS transaction completed, you earn a commission, creating a new income stream for your business.

Conclusion: AEPS – A Step Toward a Cashless, Digital India

AEPS is transforming the way banking services are delivered to customers. It offers an easy, secure, and cost-effective solution for both businesses and customers, empowering them to perform essential banking transactions with ease. By integrating AEPS into your business, you can help drive financial inclusion while creating a reliable, revenue-generating service.

Join With Sikhwal Multiservices Today

With *Sikhwal Multiservices Pvt. Ltd.*, you can take advantage of this game-changing technology, expand your business, and provide invaluable financial services to your community.

Have questions? Get in touch via the contact form or connect with our support team — we’re just one click away!