Bank B/C and CSP Banking Services – Enabling Financial Access at the Last Mile

In India’s pursuit of financial inclusion, *Bank Business Correspondents (B/C)* and *Customer Service Points (CSPs)* play a transformative role. These services extend formal banking facilities to rural, remote, and underserved regions where brick-and-mortar banks may not exist. Sikhwal Multiservices Pvt. Ltd. empowers individuals, entrepreneurs, and small business owners to become official banking representatives—delivering essential financial services at the grassroots level.

These models are recognized by the Reserve Bank of India (RBI) and are part of various public and private bank initiatives to increase banking penetration. By becoming a CSP or B/C agent under Sikhwal Multi Services, you become a vital link between banks and the public, delivering services such as account opening, cash withdrawals, deposits, fund transfers, and loan facilitation.

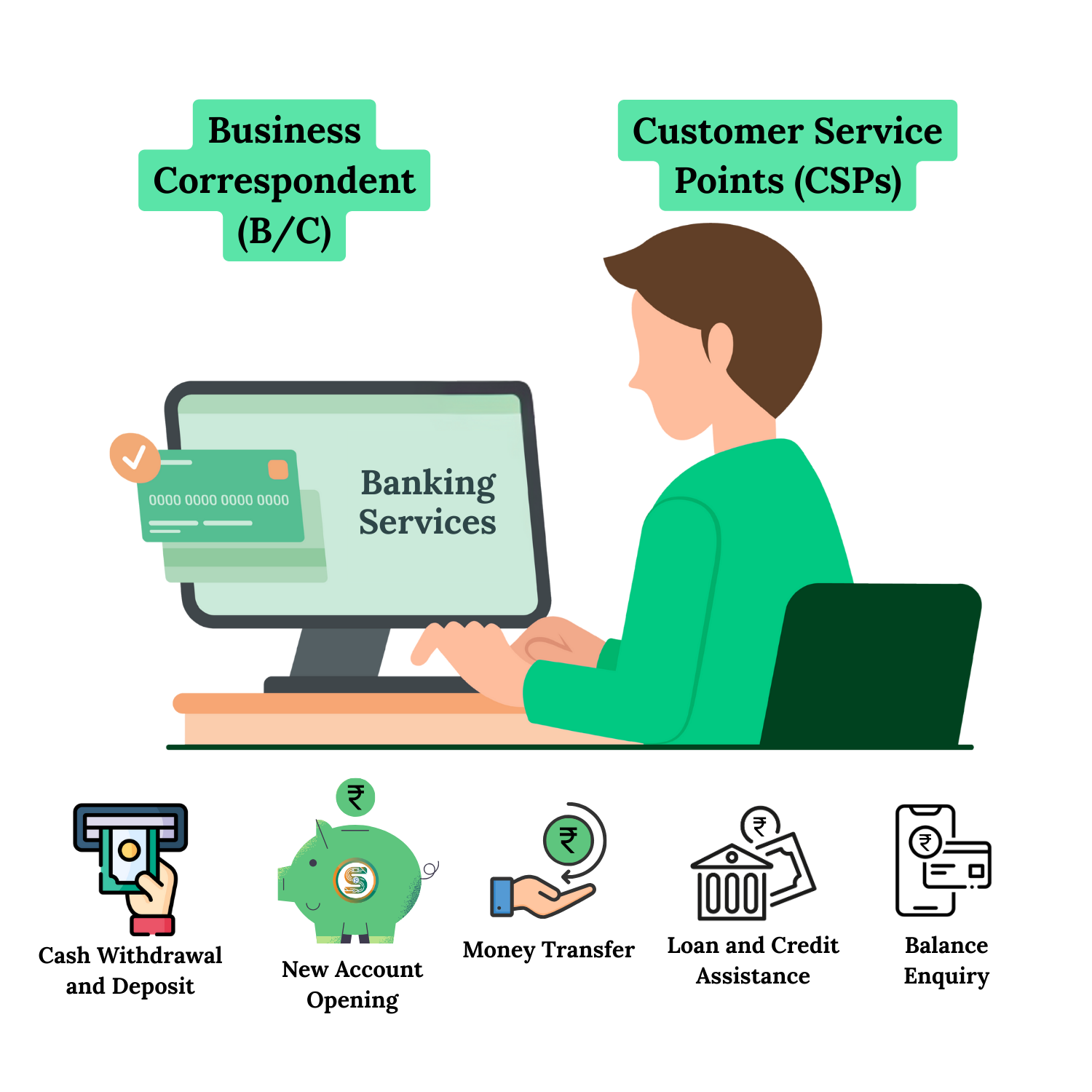

What Are Bank B/C and CSPs?

*Business Correspondent (B/C)* is an authorized individual or outlet appointed by a bank to offer basic banking services on its behalf in non-branch locations.

*Customer Service Points (CSPs)* are micro-banking outlets operated by Bank B/Cs that use secure digital infrastructure to connect users to the bank’s core systems

These setups are the bank’s extended arms, providing access to vital financial services in areas where traditional banking is either difficult or economically unfeasible.

Core Banking Services Offered via B/C and CSP Outlets-

- Cash Withdrawal and Deposit Services: Customers can deposit or withdraw cash without visiting a bank branch. Transactions are secure and conducted in real-time using biometric verification or banking credentials.

- New Account Opening: Through e-KYC and Aadhaar authentication, agents can open savings or current bank accounts quickly, ensuring every citizen has access to the formal financial system.

- Money Transfer and Fund Remittances: Customers can transfer money between accounts within the same bank or across different banks. This feature is particularly helpful for migrant workers or rural families.

- Loan and Credit Assistance: CSPs also act as facilitators for micro-loans, credit products, and government-subsidized schemes by helping customers with documentation and application processing.

- Balance Inquiry and Mini Statements: Users can easily check their account balance or request a mini statement for recent transactions, making financial tracking easier and more transparent.

- DBT (Direct Benefit Transfer) Services: Government benefits such as pensions, subsidies, and welfare funds can be disbursed directly into bank accounts and accessed through CSP outlets.

- Recurring Deposit and Fixed Deposit Products: CSPs may also help customers open recurring or fixed deposit schemes as per the offerings of the parent bank.

Empowering Local Entrepreneurs and Small Businesses

Sikhwal Multiservices Pvt. Ltd. enables individuals to open their own *CSP centers or become Bank B/Cs*, backed by full technical support, training, and integration with major banks. Whether you’re a shopkeeper, a small business owner, or a motivated individual looking for a stable income source, becoming a CSP allows you to run your own micro-banking outlet with minimal investment.

By setting up a CSP, you provide essential financial services to your community while earning commissions for every transaction.

Benefits of Bank B/C and CSP Services for Customers

- Easy Access to Banking in Remote Areas: People no longer need to travel long distances to visit bank branches. Local access to banking encourages financial responsibility and literacy.

- Time and Cost Savings: Customers save on travel time and transportation costs while enjoying quick and secure transactions near their home.

- Inclusion into the Formal Economy: With CSPs helping open bank accounts and offering financial products, individuals become a part of the mainstream economy and are eligible for loans, subsidies, and credit facilities.

- User-Friendly Processes: Biometric authentication, Aadhaar-based verification, and minimal paperwork make banking simpler and more accessible.

- Confidential and Secure Transactions: All services offered are in compliance with bank protocols and digital security guidelines, ensuring a safe and trustworthy experience.

Advantages for CSP Agents and Bank B/C Operators

- Multiple Revenue Streams: Agents earn on each banking transaction—withdrawals, deposits, fund transfers, account openings, and even financial product enrollments.

- Stable and Respected Community Role: A CSP or Bank B/C becomes a trusted financial figure in the locality, enjoying community respect and consistent business opportunities.

- Low Setup Costs, High Scalability: Setting up a CSP point requires basic infrastructure—computer, biometric device, internet connection—and can be run from a shop, home, or kiosk.

- End-to-End Support from Sikhwal Multi Services: We handle bank onboarding, documentation, device provisioning, training, and after-sales support to ensure a seamless journey for all CSP partners.

- Brand Recognition and Customer Trust: Associating with top banks and Sikhwal Multi Services builds strong brand credibility, which in turn builds long-term customer trust.

Compliance, Training, and Security Measures

All B/C and CSP services facilitated by Sikhwal Multiservices Pvt. Ltd. comply with RBI and NPCI guidelines. We ensure agents are:

- *Trained and Certified* in the use of biometric devices, software platforms, and data handling.

- Equipped with *secured digital infrastructures* to prevent fraud or data breaches.

- Capable of *guiding users* through application and authentication processes.

We also update our partners with changes in government schemes, financial policies, and bank-specific regulations to keep them informed and ahead.

The Role in National Financial Inclusion Mission

Bank B/C and CSP services are integral to the *Pradhan Mantri Jan Dhan Yojana (PMJDY)* and similar national missions that aim to bring every citizen into the formal banking system. These agents have become crucial nodes in delivering banking access, insurance, pension, and credit to the marginalized sections of society.

From tribal belts to remote mountain villages, CSPs are making “Banking for All” a living reality.

How to Start Your CSP Journey with Sikhwal Multiservices Pvt. Ltd.

Starting your own CSP or becoming a Bank B/C is straightforward:

- Apply with Basic Documentation: Submit Aadhaar, PAN, bank proof, and location details for assessment and approval.

- Get Connected to Partner Banks: We facilitate partnerships with major banks and provide login credentials for the CSP portal.

- Receive Devices and Software: You’ll be equipped with a biometric device, passbook printer, and access to a secured CSP banking portal.

- Training and Support: Our training team ensures you’re equipped with the knowledge and confidence to start your operations.

- Launch and Start Serving Your Community: Once live, you can begin servicing customers and earning commissions on every transaction you process.

Conclusion: Transforming Lives with Banking Access

Bank B/C and CSP services are not just about banking—they’re about empowerment, inclusion, and progress. Through these models, we bridge the urban-rural financial divide and make sure that every citizen, no matter how remote, has access to essential financial tools.

Join With Sikhwal Multiservices Today

With *Sikhwal Multiservices Pvt. Ltd.*, you can build a profitable, respected business while making a meaningful difference in people’s lives. Join the mission to bring banking to every doorstep.

Have questions? Get in touch via the contact form or connect with our support team — we’re just one click away!