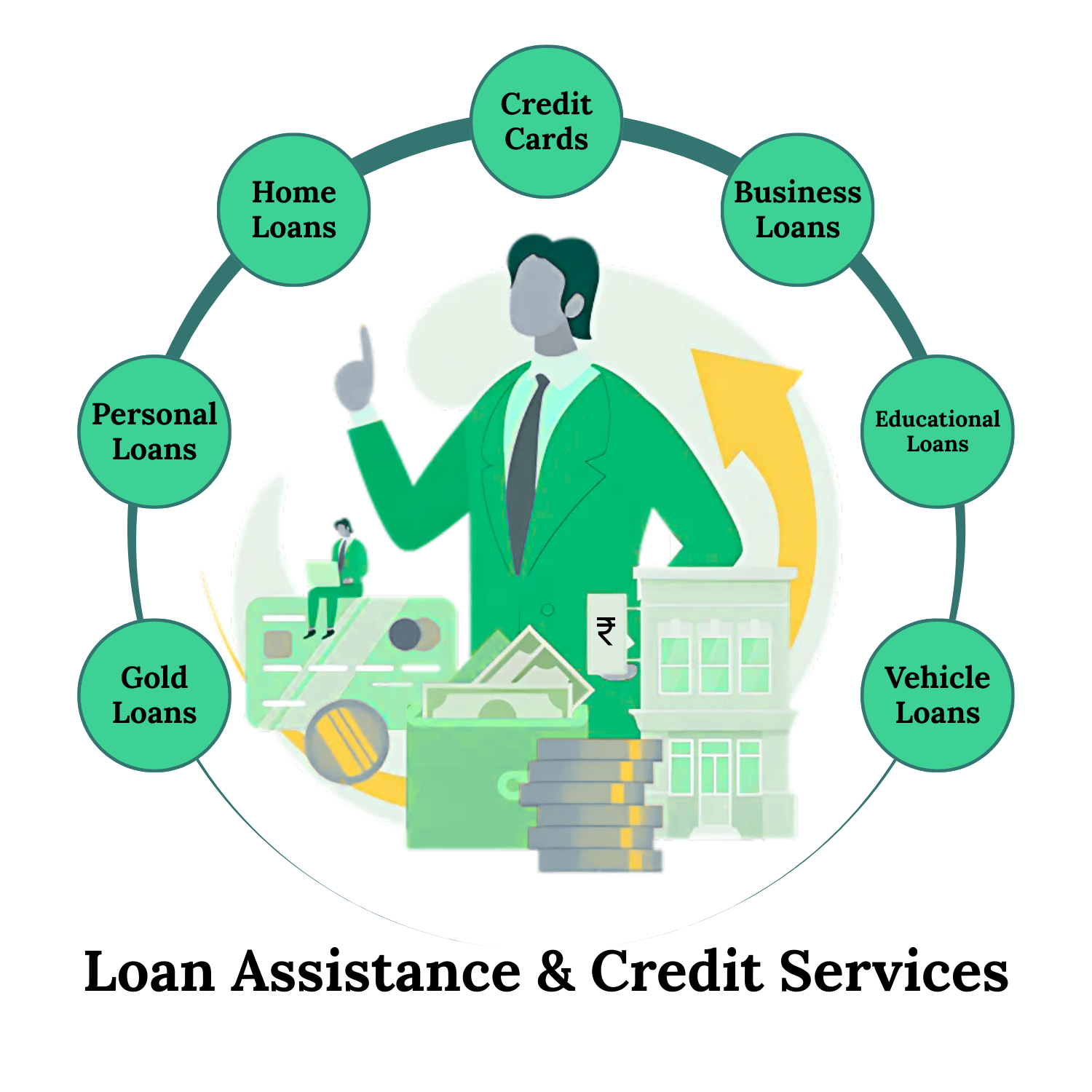

Loan Assistance and Credit Services – Empowering Your Financial Growth

At *Sikhwal Multiservices Pvt. Ltd., we understand the significance of **financial support* in times of need or for realizing long-term goals. Whether you’re looking to fund a new business venture, manage personal expenses, or invest in a property, our *Loan Assistance and Credit Services* offer accessible solutions that align with your financial requirements.

We collaborate with a network of trusted financial institutions and lenders to provide you with *customized loan options* at competitive interest rates. Whether you're an individual looking for a personal loan or a business seeking a working capital loan, our services are designed to meet diverse financial needs with efficiency and transparency.

Types of Loan Assistance and Credit Services We Offer

Our comprehensive suite of loan assistance and credit services ensures that you can find the right financial product to suit your unique circumstances. Here’s an overview of the various loan options we offer:

-

Personal Loans

Personal loans are *unsecured loans* that provide immediate financial relief for various personal needs, such as medical expenses, education fees, or home renovation. These loans do not require collateral, making them an excellent option for individuals who need quick access to funds without the need to pledge assets.- Flexibility:Personal loans can be used for various purposes, giving borrowers the freedom to decide how they use the funds.

- Competitive Interest Rates:We help secure competitive rates that are manageable for borrowers, ensuring affordable monthly repayments.

- Quick Processing:Personal loans often come with **minimal documentation* and *quick approval* times.

-

Home Loans

Whether you’re looking to buy your first home, invest in property, or refinance an existing loan, our *home loan services* make property ownership more accessible. We provide home loans with flexible repayment terms, low-interest rates, and attractive loan amounts.- Loan Amounts:We offer high-value loans that can cover up to 90% of the property’s value.

- Long-Term Repayment Options:Our home loans come with flexible repayment options, making it easier to manage your budget.

- Easy Eligibility:We help you find home loan options that align with your income level and credit score, ensuring smooth approval.

-

Business Loans

For businesses looking to expand, manage operations, or cover working capital needs, our *business loan services* provide the necessary funding to fuel growth. From *SMEs* to *large corporations*, we offer a variety of business loan products tailored to the unique needs of each organization.- Working Capital Loans:Designed to help businesses manage day-to-day operations, covering expenses like inventory, payroll, and overheads.

-

Educational Loans

Education is one of the most important investments a person can make in their future. Our *educational loan services* provide funding options for students who wish to pursue higher education in India or abroad. With low-interest rates and flexible repayment terms, we aim to make quality education accessible to everyone.- Loan Coverage:Covers tuition fees, accommodation, and other academic-related expenses.

- Interest Subvention:Some educational loans offer interest subvention during the course period, providing relief during the study years.

- Repayment Options:We help students secure loans with **easy repayment plans*, which begin after the course completion.

-

Vehicle Loans

Whether you’re looking to buy a *car, two-wheeler, or commercial vehicle, our **vehicle loan services* offer funding to make purchasing a vehicle more affordable. With flexible terms and low-interest rates, we help make your dream of owning a vehicle a reality.- Car Loans:We provide loans for **new and used cars*, with flexible repayment terms and attractive interest rates.

- Two-Wheeler Loans:Affordable loans for purchasing bikes or scooters, ensuring that your commute is hassle-free.

- Commercial Vehicle Loans:Designed to help businesses purchase commercial vehicles, improving their logistics and operations.

-

Gold Loans

If you need immediate cash for any financial requirements, *gold loans* provide a quick and easy option. By pledging gold, you can access instant funds at competitive interest rates, with minimal documentation and fast processing.- Loan Amount:The loan amount is typically a percentage of the gold’s market value.

- Quick Approval:Gold loans are processed quickly, providing fast access to funds without lengthy approval procedures.

- Flexible Repayment:You can choose from various repayment options that suit your financial situation.

-

Credit Cards

Our *credit card assistance* service helps you secure credit cards from top banks and financial institutions. Credit cards offer convenient and flexible spending options, along with *reward points, **cashbacks, and **discounts* on purchases.- Rewards and Benefits:Access to exclusive benefits, such as **cashbacks, reward points, and **shopping discounts*.

- Interest-Free Period:Enjoy an interest-free grace period on purchases made, allowing you to manage your finances more effectively.

- Flexible Repayment:Monthly installment options that allow you to spread out payments, making it easier to manage your budget.

-

Microfinance Loans

For *self-employed individuals* and *small-scale entrepreneurs* looking for financial support, we offer *microfinance loans* to empower them to grow their businesses. These loans provide quick and easy access to funds with flexible repayment terms.- Small Loan Amounts:Microfinance loans offer small loan amounts tailored to the borrower’s requirements.

- Minimal Documentation:We help secure microfinance loans with minimal paperwork, making the process quick and easy.

- Support for Entrepreneurs:These loans are specifically designed for individuals or small business owners seeking capital to improve or expand their operations.

How We Assist You in Getting the Best Loan

-

Personalized Financial Consultation

We provide *personalized loan counseling* to help you choose the best loan option based on your financial goals and eligibility. Our experienced consultants analyze your financial situation to recommend suitable loan products. -

Loan Comparison and Selection

We compare loan offers from various financial institutions, ensuring you get the most competitive interest rates and terms. This way, you can make an informed decision about the loan that fits your needs. -

Documentation and Paperwork Assistance

Our team assists in completing the necessary documentation and provides guidance on what documents are required, making the application process simple and transparent. -

Hassle-Free Application Process

We streamline the loan application process, reducing the time it takes to apply and get approval. Our efficient systems and partnerships with leading lenders enable fast approvals and fund disbursements. -

Post-Loan Support

Our commitment extends beyond the loan disbursal. We offer ongoing support with *loan repayment* management, *refinancing options, and **advice on maintaining a good credit score*.

Why Choose Our Loan Assistance and Credit Services

-

Wide Range of Loan Products

We offer a *comprehensive range of loans*, from personal loans to business financing, ensuring that all your financial needs are covered. -

Expert Guidance

Our experienced team of financial experts is dedicated to providing *customized solutions* that suit your unique needs, ensuring that you secure the most suitable loan with the best terms. -

Fast Processing and Approval

We prioritize efficiency, ensuring *quick loan processing and approval*, allowing you to access funds when you need them the most. -

Competitive Interest Rates

Through our trusted network of financial institutions, we help you secure loans with *affordable interest rates*, keeping your repayments manageable. -

Transparency and Integrity

We operate with complete transparency, making sure you understand the loan terms and conditions upfront. There are no hidden charges, and our process is clear and straightforward.

Conclusion: Unlock Your Financial Potential with Sikhwal Multiservices Pvt. Ltd.

Whether you're an individual or a business, *Sikhwal Multiservices Pvt. Ltd.* provides reliable and accessible loan options to help you achieve your financial goals. From *personal loans* to *business financing*, we offer flexible and affordable solutions that make borrowing simple and stress-free.

Our expert team is here to guide you through every step of the process, from application to approval, ensuring that you secure the best deal. With our loan assistance and credit services, you can *empower your financial future* and unlock new opportunities for growth.

Join With Sikhwal Multiservices Today

With *Sikhwal Multiservices Pvt. Ltd.*, you can build a profitable, respected business while making a meaningful difference in people’s lives. Join the mission to bring banking to every doorstep.

Have questions? Get in touch via the contact form or connect with our support team — we’re just one click away!